-

Networks Partner to Catalyze Impact Investing in Africa

Leading investor networks join forces to connect investors and increase financing of African enterprises that create positive social and environmental impact. Nairobi, Kenya / Seattle, USA – Africa offers arguably the highest potential impact investment opportunities globally and is poised for strong economic growth. However, this can only happen if these opportunities are strategically matched with […]

-

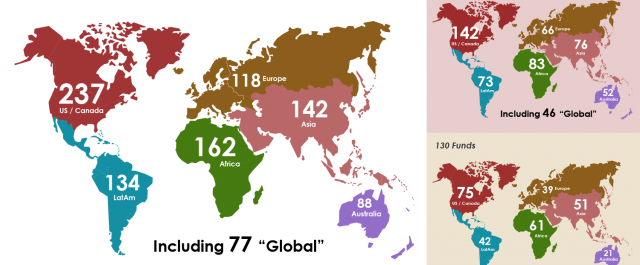

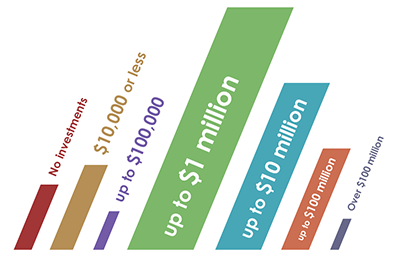

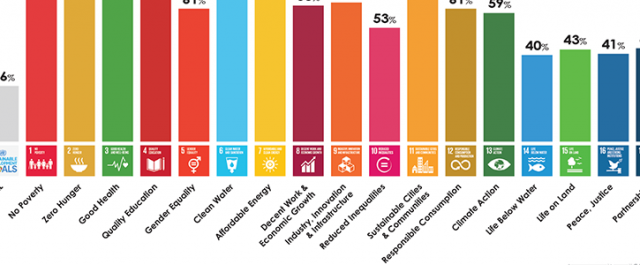

Report: 327 Investors

Who, What, Where, and How: 327 Investors Who are these “so called” impact investors? Where do they live? Where do they invest? What sectors do they invest in? Which stages of growth? What investment structures do they use? This report attempts to answer those questions, based on the profiles of the first 327 investors in […]

-

Report: The First 205 Investors

Who, What, Where, and How: The First 205 Investors Who are these “so called” impact investors? Where do they live? Where do they invest? What sectors do they invest in? Which stages of growth? What investment structures do they use? This report attempts to answer those questions, based on the profiles of the first 205 […]

-

Ziweto Enterprise closes acquisition

Thanks to interest by investorflow.org investors and others, this Malawian venture raised $112K+ to acquire competitor Alfa Medics and extend its impactful livestock veterinary supply chain nationally, increase revenues seven-fold, and generate profits to grow the company sustainably using retained earnings. Full story.

-

Harder to find a co-investor than a mate?

There’s no shortage of quality investment opportunities for impact investors. But trying to find co-investors to fund a deal is far from easy. Not unlike philanthropists, their interests vary greatly. Much more than tech investors. And they live all over the world, not just in Silicon Valley. In an era when you can meet your future spouse using […]

-

Report: The First 151 Investors

Who, What, Where, and How: The First 151 Investors Who are these “so called” impact investors? Where do they live? Where do they invest? What sectors do they invest in? Which stages of growth? What investment structures do they use? Our first report attempts to answer those questions, based on the profiles of the first […]

-

A busy day

Impact investors are picky. They each have specific sectors, geographies, stages, and scale that have to match their interests, in addition to the standard needs of liking the team, the plan, and the opportunity. Case in point: today we circulated a total of eight deals shared by lead investors. In total they matched 43 of the 140 […]

-

Tomatoes, schools, vet supplies — oh my

What do Nigerian tomatoes, Indian private schools, and Malawi veterinary suppliers have in common? They represent three of the most recent impact investment deals (a.k.a. “flows”) shared by lead investors seeking like-minded investors via investorflow.org: Tomato Jos, SEED Schools, and Ziweto Enterprise. They also underscore how impact investors are all around the world and have a wide range of investment preferences. Now that […]

-

Watch out… they’re everywhere

It’s day 77 since we launched investorflow.org, and we’ve been so busy signing up investors that we didn’t have a chance to look at where these investors live. As we passed the 100 sign-up milestone today, we pause to answer that question. They hail from no fewer than 20 countries and six continents (as no […]

-

We’ve lost count… already

Two months after launching investorflow.org, and we’ve already lost count of the number of investors in the network. It’s not that we can’t count the number of sign-ups and investor profiles, that’s easy. The problem is that a dozen of these profiles are for funds and foundations, and a few are for whole groups of […]

-

50 investors in the first 31 days

It’s rare when a new idea gets adopted quickly, but when it does look out, as the world can change in what later feels like an instant. Impact investing is having that feeling now, as the idea is grabbing the attention of more and more people. 2,500 impact investors and social entrepreneurs make the trek to […]

-

Linking investors with like-minded followers

One problem slowing down investment in social enterprise startups is a simple matter of numbers: It’s difficult to get enough investors together to raise the necessary financing, because they tend to be scattered all around the world…. Plus, even if there’s an acceptable number of impact investors in an area, chances are they aren’t all […]

-

Ready to join?

It’s time to start adding investors and flows. If you are an impact investor interested in joining the network, please contact us below. If you are an impactful entrepreneur seeking funding, contact us too, but also please introduce us to your existing investor(s). [contact_form email=”concierge@investorflow.org” subject=”MESSAGE from investorflow.org (Ready to join blog post)” checkbox_investor=”Impact Investor” […]

-

Not dealflow, but investorflow

The reality is that most startup investments do not come from companies pitching investors, but from investors pitching their fellow investors. The problem isn’t a lack of dealflow, nor a lack of crowd. The problem is efficiently matching the right deal to the right investor, one investor to another. Or more simply… the problem isn’t […]